Deep Dive On Solana Summer Camp Grand Winners

Grand Champion

Ironfroge

Ironforge, a platform for developers that provides a simple way to build, deploy, and maintain applications at the speed of thought. In an attempt to put Web3 on par with Web2 in terms of simplicity and ease of collaboration, Ironforge tool suite provides automated deployments, program previews, auto-generated APIs, monitoring and more. It enables teams to iterate quickly and safely, so they can focus on what matters most: building great products.

With a modest developer’s retention rate of 30% in the Solana ecosystem, Ironforge is positively anticipating that with this new technology (Ironforge) not only will this rate tend to increment but there will be a massive spike in the total number of developers which currently is just above 2200.

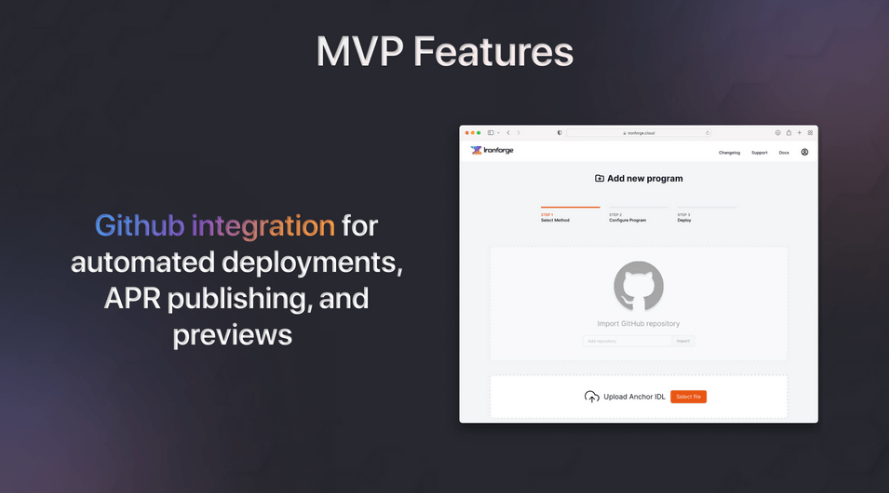

The platform’s MVP elements, which are at the heart of what make it so fantastic, are proudly disclosed by the creators. The straightforward GitHub integration functionality offered by the platform is the reason they (the founders) are so convinced that developers (particularly frontend) will now work with less complexity and more comfort. By simply connecting the Solana program’s GitHub repository to the Ironforge platform, it enables Automated Deployments and Anchor Program Registry publication with each push.

It also makes possible preview of the program even before it reaches the final stages of production or before it is deployed to the Devnet or Mainnet.

It does this by creating an Ephemeral cluster and preview links that can be shared between technical and non-technical stakeholders. The Ephemeral cluster holds the program and its dependencies in the platform temporarily while the links enable the program to be preview and interacted with even with a browser.

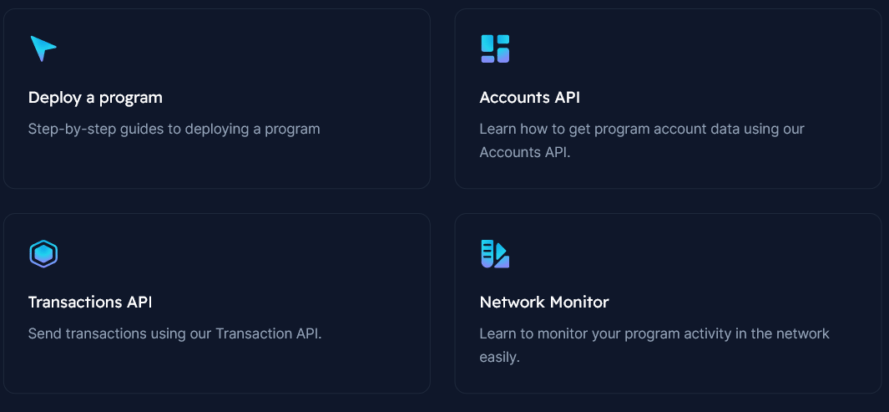

Apart from that, Ironforge auto-generates based on the program IDL, APIs for easier and more flexible network interaction. The Accounts and Transaction API allow for more flexible and powerful queries and simplify development between platforms that may not be able to share SDKs. The Accounts API makes it easy for data to be retrieved and accessible in frontend developments whilst, the Transaction API ensures transaction errors are handled intelligently, and failed transactions are automatically retried. Low-level errors are quickly traced and identified.

With the implementation of such APIs, there is always a possible of a downtime in execution. That is why Ironforge has a unique feature known as RPC load balancing.

The concept of this explains that these APIs interact with the Solana network through an RPC load balancer that ensures higher uptime and faster network access. By spreading the load amongst multiple RPC providers, Ironforge can automatically shift the load to the RPC provider with the best current performance. That way, frontend developers can focus on making a better frontend and not worry so much about infrastructure and network communication.

To sum it up, Ironforge ensures that everything is monitored. By everything we mean, Ironforge helps you diagnose issues sooner and grow one’s business faster with a comprehensive end-to-end monitoring system. View API and program logs, track events, view API usage metrics, and more. All of it clearly surfaced so one can make better development and business decisions.

Conclusively, Ironforge improves the Solana experience for developers, non-developer stakeholders, and end users. It helps you build better frontends faster; simplifies program iteration; and provides comprehensive log, metric, and event monitoring.

These four features, being well implemented are what (in our opinions) made Ironforge “deservingly” carry the grand prize of $65,000 (USDC) in the Solana Summer camp 2022.

References: https://docs.ironforge.cloud/, https://blog.ironforge.cloud/introducing-ironforge, https://solana.com/summercamp/voting/ironforge, Ironforge Presentation Slides

Payment Track

Sphere

In order to allow individuals, NFT developers, and businesses easily accept Solana payments, boost consumer interaction, and manage their online crypto store, Sphere is a payments infrastructure for Solana that provides custodial and non-custodial payments options. This year’s Summer Camp Hackathon’s Payments Track category was won by Sphere, with a reward of $50,000 in US Dollar Coins (USDC).

Potential of Sphere

The creators’ main goal that they want to see accomplished with Sphere is to help facilitate adoption of Solana payments. According to them, “over the last few years blockchains have turned from these clunky machines that you know can process payments in 10 minutes to things that can process and settle transactions lightning quick” and with Solana being the fastest blockchain with a block-time of 400milli-seconds, the creators are optimistic to take these kinds of payments mainstream while offering the most competitive pricing for internet payments period.

What this technology introduces to the Solana ecosystem is going to be VERY helpful to customers and merchants in the network. A deep dive into what this technology;

IT IS USER-FIRENDLY

Sphere’s core aim is to help empower individuals, NFT creators and companies seamlessly accept Solana payments, increase their customer engagement, and manage their online crypto store. In a nutshell, Sphere is a collection of payment solutions right at the fingertips of their users. The developers ensure’s that this technology offer both custodial and non-custodial accounts so whether you’re a web3 veteran who knows all about self-custody or a mom-and-pop shop who’s just trying to get into Solana payments and Solana in general they’ve got you covered.

IT IS EASY TO USE

On the merchant side, the creators offer an easy-to-use SDKs and also interfaces that are no code for them to create their online store and on the other end they also provide pre-can solutions (such as PoS app, Checkout page etc.) to provide delightful experiences so that customers can purchase products and services

ONE PLATFORM FOR ALL COMMERCE NEEDS

Sphere aims to be one platform for all of Solana commerce needs. Although it’s atomic payments/settlement is described to be down but they are quickly building towards subscriptions and also payouts to cover the full gamut of payment solutions.

INTUITIVE, ROBUST, USER-FRIENDLY APIs

Elle, one of the creators said that, “one of the most important things to consider when building a modern payments platform is the use of intuitive robust and user-friendly APIs”, in this light, they take the best of what already exists in web 2 and put it to web 3 abstracting all of the on-chain transactions so that developers don’t have to worry about it and can instead write beautiful code that does what it needs to do.

A PERMISSIONLESS AND TRUSTLESS DeFi PROTOCOL

Sphere is built on top of a “permissionless” and trustless DeFi protocol and this is the main processing engine that the creators use to ensure fair and secure exchanges and interactions between merchants and customers.

READY-MADE ONLINE STORE AND OTHER PRODUCTS

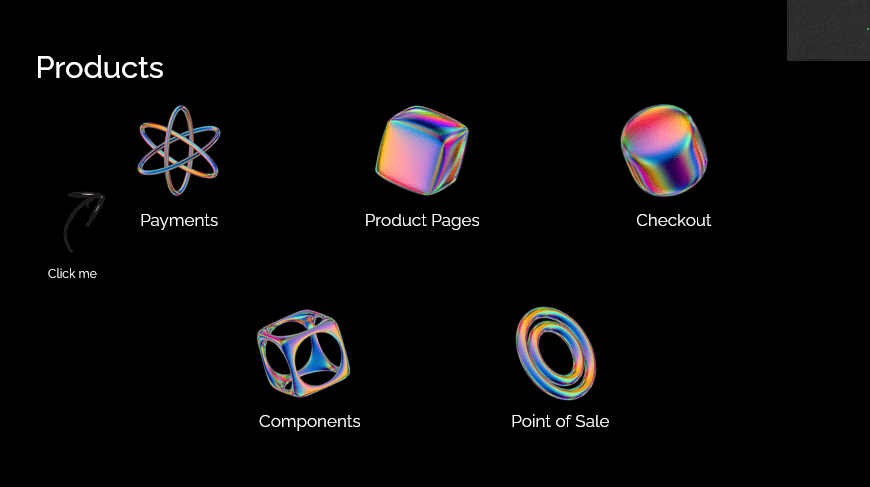

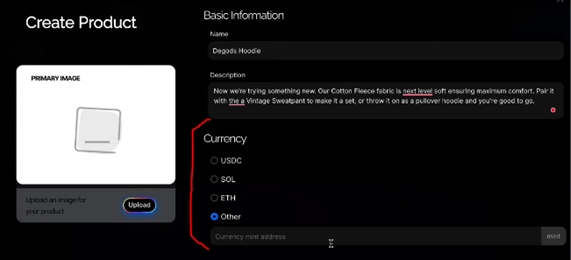

This technology allows you to create your own fully functional online store with the click of a few buttons. The store comes with a number of useful products to facilitate a smooth flow of business as we have today online stores doing and even more. These products are listed below:

- PAYMENT page where payments are accepted with Solana tokens

- PRODUCT page that is seamlessly auto-generated. It contains every detail that the customer needs to know about the product

- POINT OF SALE (PoS). Sphere has a PoS application which allows for Solana payment to be accepted in person and is directly connected with products and inventory in the store.

- CHECKOUT page. Every product create automatically generates a checkout page that you can send to users.

- Lightweight COMPONENTS libraries which allow developers to embed a buy now button to any site. Sphere supports React framework.

SUPER REASONS WHY MERCHANTS AND CUSTOMERS SHOULD USE SPHERE

The Creators believe below are some of the reasons why one might consider using Sphere:

- It is blazingly fast

- It incurs zero fees. They really believe that internet payments should be free and blockchain allows for this to be possible.

- Sphere is developer friendly and no code. This points to tell us that it caters to teams and businesses without engineering teams and also to people who are only developer focused. For the last set of people, Sphere has the tooling to help them achieve their goals

- It also has a wide-based community where one can join any of the platforms (twitter, discord and GitHub) and interact with fellow users and developers

- Some of their libraries and SDKs are open source and they encourage requests from the public for contributions to these codes by of doing constantly allowing new ideas to be implemented and ultimately improving performance.

- Solana Program Library (SPL) tokens are assets that live on Solana’s network. Sphere supports any SPL token. You can either select from the given options or specify the token by inputting the mint address.

Conclusion

Sphere is a full stack Solana payments solution at your fingertip. It simplifies the process of accepting Solana tokens as payment and provide elegant interfaces and developer tooling so that you can focus on selling your online products. It offers pre-built checkout pages, React components and other products to get you up and running in minutes.

References: https://sphere.engineer/, Sphere Presentation Slides, Youtube Demo video, https://sphere.engineer/products/payments, https://sphere.engineer/products/product_pages, https://sphere.engineer/products/pos, https://sphere.engineer/products/checkout, https://sphere.engineer/products/components

Web3 Track

Ora

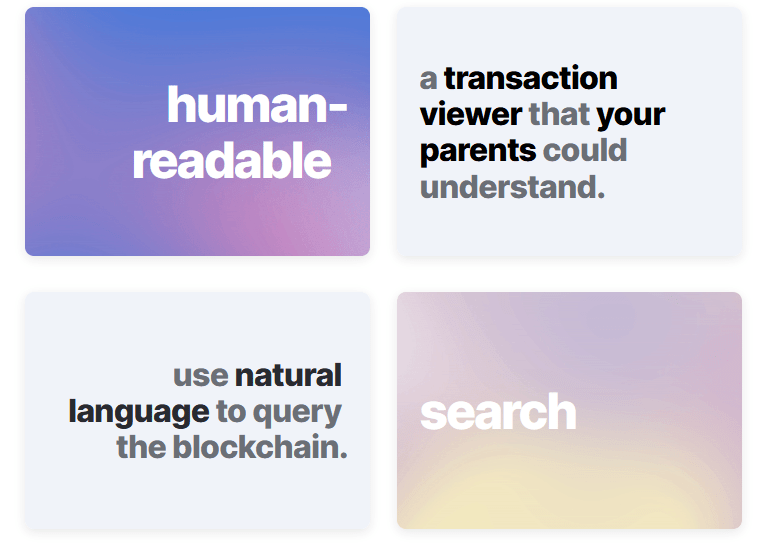

The first search engine for blockchain data, it accepts a query as input just like any other search engine and uses Open AI codex to convert it to sql query syntax.

The issue they are resolving is: Ora believes it is crucial for regular users to be aware of the daily activity on the blockchain.

such as how many NFT were sold on Magic-Eden in a specific time period or which Jupiter swap occurred over 10 sol; they think that such inquiries require none sophisticated answers increasing user awareness of the technology (WEB 3).

They want the average internet user to be able to understand blockchain activities by making simple queries as in a normal search engine. The potential of this is fantastic as it breaks the complexities around blockchain to the public thus creating awareness and sparking interest.

The blockchain explorer presents all transactions but with a complex structure that seems not so easy for none savvy blockchain users to understand, and get an inkling of all of what is happening and it is this complexity that Ora has proposed a solution to.

It is excepted that with the Ora search engine users must be able to make queries in human readable language on the blockchain with an easy transaction viewer which can be understood by literally anyone.

References: https://www.loom.com/share/dc9a735bd7cb40ed80f00219294ce9fe, https://cryptoslate.com/a-new-blockchain-search-engine-ora-emerges-from-solana-hackathon/

Climate Award

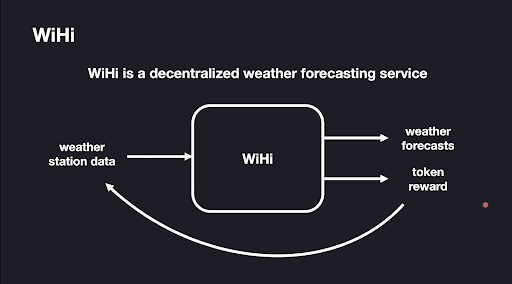

WiHi

WiHi is a decentralized weather forecasting and climate monitoring system that rewards weather stations for contributing data to the network with tokens, with rewards corresponding to the value of the corresponding data for forecasting. Created at Noetika Technologies by Uros Kalabié, and Michael Chiu. Noetika Technologies is a boutique blockchain shop based in Novi Sad, Serbia, focusing on blockchain for infrastructure.

The owners of the data that feeds the wihi platform are rewarded with a token, and this is based on the quality of the data they provide. Solana(Block chain Technology) provides a good incentivization scheme that solves everything.

- Wihi allows people to set up WiHi-enabled weather stations

- Stations send data to Wihi and obtain Wihi tokens in return

- Amount received is proportional to the improvement in forecast.

This is how it works on the system level:

Wihi forecast model takes public weather stations data and performs forecasting assimilation with their wihi data assimilation algorithm. The assimilation model also takes private data provided by wihi enabled weather stations and then modifies the forecast.

The assimilation model compares the data and then determines the quality and what the reward should be for the owner of the weather station.

Wihi incentivizes weather sensor development, Wihi is well-placed to take advantage of current trends in weather sensor development, Wihi also, incentivizes integration with the current state-of-the-art:

Sea craft based, aircraft-based and long-range sensing solutions

References: https://noetika.tech/weather, https://vimeo.com/740243385

University Award

SolStamps

SolStamps is a software designed to solve email phishing by linking user identities to Solana Wallets. SolStamps is a Web3-centric software creating trust in the email environment.

While the majority of anti-phishing software programs check that emails came from the correct domain (DMARC) or servers (DKIM), SolStamps adopts a novel strategy by authenticating the sender’s identity.

Emails sent with SolStamps can be automatically verified by the recipient as coming from the correct sender.

This sender confirmation serves as a defense against sophisticated, challenging-to-detect phishing attacks, including spear phishing, business email compromise, and identity impersonation, to which both individuals and corporations are subjected and targeted by criminals seeking to steal sensitive and private data.

References: https://solstamps.io/, https://youtu.be/hWS7zZ_JlLw

Gaming Track

RPG Quest

RPG Quest is a lightweight, pixel multicharacter, play-to-earn dungeon game built using Phaser (2D game framework used for making HTML5 games for desktop and mobile), powered by Metaplex (an open source protocol for the creation and use of digital assets on the Solana blockchain). The mission of the Solana RPG Quest game is simple, “OWN WHAT YOU EARN”.

Before we take a deep dive into the problem that brought the inspiration, solution that has been implemented and how the game works in general, let us briefly see why the develops chose to build this masterpiece on the Solana blockchain.

REASONS FOR BUILDING RPG QUEST ON SOLANA

One of the main reasons as we may all be aware of at this point is that Solana is very fast. It is only ideal that RPG Quest is built on Solana, taking advantage of its speed as the game itself requires that due to the many transactions and processes going on. Apart from that, Solana fees are very low and affordable; Solana has a cheaper storage rate; Solana has “fairly” rich capabilities to process data within the smart contract; and in the Solana ecosystem, this will be a great opportunity for the gaming community especially with the introduction of NFTs and their utilities.

THE PROBLEM

The developers presented a clear problem affecting the gaming community now-a-days. It can be said that traditional gamers don’t really have full control over their in-game assets. It is scary to know that as a gamer after spending multiple hours on acquiring these assets they get lost, gone forever just like that with an account ban or deletion for any reason on a particular gaming platform. Gamers need to be in control in and outside of the gaming platform over what they’ve worked for.

Here is where RPG Quest’s winning idea comes in. They provided a very simple yet very useful solution to this problem which deservingly won them the Gaming track prize of $50,000 USDC.

THE SOLUTION

The solution involves a process of ensuring prizes can be won in the form of NFTs which get stored in the Phantom wallet. This solution also allows gamers or artists to mint gaming characters and practically make use those characters available for use in the game.

HOW IT WORKS

The process begins by linking/connecting the Phantom wallet to the game. The game is built with Phaser and React. Once you collect a chest it gets you a loot (a Solana Program Library “SPL” token) which makes a call to the Escrow account. The Escrow (a third-party smart contract that holds the deposited tokens until the payment conditions are satisfied) gives you a reward of 20 dungeon tokens (20 DUN tokens) which gets stored in the token account of the token smart contract. If the loot is collected then it gets stored in the game data account and it gets mapped to the game state which allows for the token to be used within the game. The game data account also has a Metaplex candy machine mint wherein creators can create and sell NFT assets and also buy assets and these assets can later be equipped in the game. Users also get an NFT level pass after they finish the game.

The NFT storefront which comes in the game can be used to buy characters and then later equipped/use in the game. Upon buying the character you can demo-view it looks and features before claiming the purchase. Once you claim the purchase it reflects in your game dashboard, in your trophy cabinet and not only there but can be seen also in your wallet. The characters can be selected and unselected and automatically reflected in the game.

MAJOR FEATURE OF THE GAME

Game data is stored on-chain which means that the user can’t collect treasure (SPL tokens) previously collected. In simpler words, every chest in the game is unique and the content in the chest (loot/SPL token) can be only owned by the user that collects it first.

Other Features include:

- Secure authentication with phantom wallet

- In Game Store

- NFT rewards as Level Passes that get stored in the Phantom Wallet

- For every Loot (SPL token) the user gets a real token, $DUN (Dungeon) Token as Rewards

- Auto save game progress on chain

- Metaplex Game storefront for buying game characters and using them as game assets and as NFT. Every character is Rare and has unique abilities.

- Decentralized storage powered by ARWEAVE

- Using Metaplex NFT storefront powered by Arweave, one can claim a character by minting it on the marketplace and later equip it by selecting/unselecting it from the trophy cabinet in the user’s dashboard.

- Swap $SOL for $DUN (game token), on serum DEX swap (ALPHA) in game to deposit token in escrow to play

Conclusion:

RPG Quest, a dungeon game was built to ensure its users practically own what they earn. It was a brilliant step taken by the developers to bring this idea into life. Now, in the form of NFTs users can get rewarded for passing game levels and within the game be rewarded with real-life token for every treasure found in the dungeon. It is a win-win case by making money in the game and essentially making it out of the game with the rewards won.

DAO’s Track

Bastion

For the DAOs (Decentralized Autonomous Organizations) track, first place went to Bastion, which allows a DAO to become a wallet that transacts across Solana dApps and signs governance proposals, which secured a prize of $50,000 in USDC.

Essentially what this technology does is provide a more interactive User Interface (UI) and User eXperience (UX) through a wallet technology for DAOs to be able to perform operations more visually and with ease. The creator, Tristyn Stimpson saw this as an opportunity to solve the UI and UX problem faced by many in the DAOs community.

THE PROBLEM

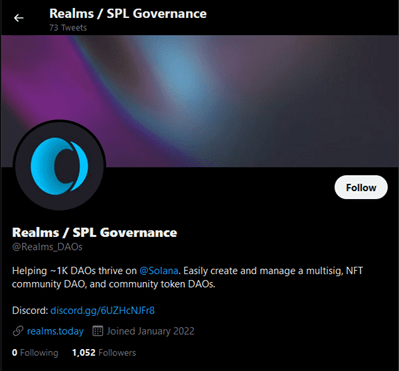

To begin with, DAOs on the Solana ecosystem use Realms which is a Solana based platform for builders on Solana to create a DAO, manage their members, vote on proposals, and allocate their treasury. Whether you are running a multisig (short for multi-signature addresses), NFT community DAO, or community token DAO, Realms believe they have the tools and integrations to help your community flourish.

“Realms serves as the frontend for SPL Governance, a DAO-type and asset-type agnostic standard for building and maintaining DAOs on Solana.” – Realms.today

While Realms have done much to ensure life is easy for DAOs in the network, Tristyn believes there are still limitations:

The SPL governance program owns the PDA (Program Derived Address) of every DAO. The PDA controls the treasury of that DAO, however there is no physical user interaction going on because there is no user interface where that PDA can act like a regular wallet and connect to any typical front end known. As a result, a few limitations are birthed. These limitations as described by the Bastion developer are highlighted below:

– DAOs can’t log on to Decentralized Exchange (DEX)/trading platform such as Mango market etc.

– They can’t connect their wallets to dApps

– DAOs are left in the dust in that they are second class in comparison to regular users. This is so said because apart from initiating a proposal and casting votes, the only option a DAO has is to fill out forms on Realms.

Another major problem is that out of a total of 632 protocols only 12 protocols are integrated with Realms. Developers building a protocol have to spend extra time going into realms.today, adding their protocol integration to the Realms front end and that will incur a huge amount of man hours if truly they want all of the different protocols to be accessible to DAOs. Tristyn thinks that is not sustainable and that there should be a much better way

THE SOLUTION

To remedy this, developers (protocol developers and front-end developers) will have to find a way to support DAOs in their application. This can be done by adding the Bastion wallet adapter and that will allow users to connect a DAO to their front end. This is a general-purpose solution – it will generally work with any type of front end. Also, any type of transaction can be taken and converted to a multi-sig proposal.

HOW IT WORKS

– First create a DAO

– In Realms, initiate a transaction. When initiating a transaction, select the “Bastion: Connect to dApp” option

– Ensure Bastion wallet adapter is added to the dApp. Click to connect the wallet which will pull up the WalletConnect interface which will bring up the link that you copy and paste in Realms and establish the connection.

– You will notice after the connection that the treasury address can be seen both on the dApp and Realms interfaces verifying that the connection was successful.

– Once this is done, you are all set! You can transfer tokens, execute other transactions through the UI of the dApp and find the proposal automatically waiting to be pushed for approval/voting by the DAO members in Realms.

Conclusion

You can now connect Realms and the treasury public key of your Realms DAO to a front end and it shows the realms public key in the front end and it can sign transactions and behave as if that DAO on realms is any regular user. Bastion also has a use case for institutions where the institution can keep a high amount of security for their funds and the institution would be able to interact with any protocol that they like regardless if that protocol is so new that they don’t have a realms integration. Then there’s also a really interesting use case with XNFTs (executable NFT) in that you the Bastion wallet can display XNFTs, connects to a realm style or Goki Multisig or any other kind of Multisig program then in the wallet you can open up a XNFT and any transactions that are created in the XNFT are automatically converted to proposals in your DAO.

References: https://twitter.com/realms_daos?lang=en, https://docs.realms.today/DAO-Management/Introduction, https://github.com/bastion-multisig/multisig/tree/db344b88c81d3050c5e59cc21d418fc006f9922a, https://www.youtube.com/watch?v=Ey7yEWqsDNk.

DeFi Track

Dual Finance

DIPs, which are effectively covered call (upside) or put (downside) positions, are created to give users more yield than HODLing in volatile markets. The instrument might be referred to as Dual Currency Deposits in conventional finance, most specifically foreign exchange. Even though these products are built on straightforward derivative structures, Dual Finance’s use of Upside DIPs and Downside DIPs has a number of important advantages over earlier iterations.

The execution of current SPPs is done so shoddily that there is a lot of slippage. The SPP administrators presently hold their own weekly Friday auctions in which they all offer 1-week options. Prior to the start of the auction, market participants are aware of the schedules, sizes, maturities, and strikes for each SPP. By selling volatility OTC or across screen markets before auctions, it is inevitable that these order flows will be front-run to some extent, which will lead to poorer pricing for users. Additionally, if you invest money in SPPs, you could not see a return until the first Friday after your deposit, when your investment is first put at risk. The current SPPs can also be manipulated, allowing you to take money out of a vault early to prevent losses if you know it is at risk of losing money. Ironically, consumers are responsible for paying set management fees for all of these bad habits.

Instead, Dual Finance uses a stated APY% and its stablecoin premium to stream DIP pricing. This quick access to liquidity is a critical product advancement. DIPs offer a live executable price that may be sold at any time, as opposed to all users pooling into a single strike, maturities, and price that is sold all at once. Due to this, Dual Finance uses streaming prices rather than weekly auctions to provide rolling subscription periods. In order to gain a spread, Dual Finance may take principle risk positions on the DIPs or outsource risk to partner market makers.

Users who can better time movements in the underlying asset and more quickly trade delta neutral positions thanks to the streaming nature of the DIP prices are able to better manage risk. In the end, users have a lot more control and flexibility over their yielding DIP placements than SPPs.

The APYs provided by SPPs are only a rough indication of their goal yield; the actual return will depend on changes in the underlying price over the auction period as well as the general level of volatility demanded for each underlying product. SPP just modifies the 1-week option strike prices to determine the target yield for auctions. Over time, this has the impact of lowering aggregate APYs and front end implied volatility. Furthermore, concentrating risk on a few strikes might lower their relative demand and raise pin risk.

The benefit of this approach is how straightforward it is. Dual Finance stresses that all users should be fully aware of the risks involved, and while if APY quotations will be offered, they are just meant to be helpful in comparing comparable premiums across strikes, maturities, products, and other protocols. In contrast to SPPs, users are also compensated for premium at the time of subscription. Given that it is unencumbered and may be used right away to redistribute yield farm somewhere, that instant liquidity has tremendous value.

To prevent the dDelta risk that exists in all cash settled SPPs, DIPs are physically settled. If they wish to keep their delta risk flat at expiry, both manufacturers and users must hedge the fixing price. In practice, this can occasionally be challenging, particularly when dealing with less liquid underlying items that are vulnerable to significant slippage, which affects the original option pricing. Since physical settlement does not require an index or oracle price feed to settle, which can be manipulated against users, it more easily widens the universe of assets that are eventually available.

Staking Options (SO)

Staking Options, a ground-breaking liquidity incentive mechanism, is being implemented by Dual Finance. By offering free upside optionality on DUAL, SOs match the incentives of users, liquidity providers, and the treasury, in contrast to present yield farming and liquidity incentives, which grant users a percentage of the token rewards for free based on their share of a pool or other participation variables. Instead of free tokens, there are now free token options. By requiring rewards to come with longer term right-way skin in the game, SOs ameliorate any protocol tokenomics that artificially inflate the token value and deplete the treasury. Within Dual Finance and more broadly across all of Decentralized Finance, this innovative SO concept has many benefits.

There are two SO subcategories offered by Dual Finance. First, users that lock up DUAL for predetermined amounts of time are given General Staking Options (GSOs). Stakeholders are rewarded with complimentary OTM DUAL American call or put options. Users will pay the exercise settlement amount in stablecoins to the treasury and in exchange will receive DUAL at the strike price if the protocol token performs well and an Upside GSO is worthwhile exercising at any point. In contrast to DIPs, which really pay a premium that is modeled as an APY, the GSOs present value or premium can be treated as an APY.

Dual Finance offers two subcategories of SOs. First, General Staking Options (GSOs) are issued for users who lock up DUAL for fixed periods of time. As a reward, stakers receive free out-of-the-money (OTM) DUAL American call or put options. If the protocol token performs well and an Upside GSO is worth exercising at any point, users will pay the exercise settlement amount in stablecoins to the treasury and in return receive DUAL at the strike price. The GSOs present value or premium can be modeled as an APY, opposite to DIPs which actually pay a premium modeled as an APY.

The second way that SOs are used by Dual Finance is as liquidity incentives on specific DIPs, or liquidity staking options (LSOs). Users that have staked to a DIP will earn free DUAL LSOs. Whether a DIP is upside or downside, the LSOs will correspond to that type. When it comes to Downside LSOs, the Treasury will purchase back DUAL tokens, increasing income for users and letting them assume some of the risk when token performance is subpar.

The SO idea inherently encourages protocol token liquidity as a positive byproduct. Owners of these SOs are motivated to gamma trade the options as a result of being granted long optionality on DUAL, basically market making for the DUAL token. You would have options on DUAL if you had directly joined the GSO pool or any DIP. You are naturally motivated to sell DUAL into the market to hedge your long delta during DUAL rallies, and you are similarly motivated to purchase your short DUAL delta back from the market during any sell-off.

Rehypothecated Lending Pools (RLP)

Rehypothecated derivatives trading, in which banks use client collateral for their own objectives, is a frequent practice in traditional finance. While Dual Finance requires stablecoins or the token for Upside DIPs or Downside DIPs to properly collateralize user deposits, additional yield lending those assets is still achievable through Dual Finance via RLPs. Market makers will pay to borrow tokens from the RLPs in order to hedge their delta if they desire to engage in Dual Finance by acquiring DIP risk.

The greatest amount market makers may borrow will be limited by their long exposure to any DIP. However, borrowing DIP tokens from RLPs will not require collateral. Any market maker’s inclusion on a whitelist for RLP participation and authorization to obtain collateral from DIPs will require DAO approval. If RLP borrows are not returned prior to option expiration, fees will be assessed. A market maker must also repay any borrowed tokens to the RLP in full before they may use any DIP.

This procedure will be backed up by DUAL tokens, which will be used to always return DIP monies in full by buying any necessary tokens. RLPs increase market makers’ capital efficiency by motivating them to create tighter markets and providing customers with a second, entirely positive variable yield component on their DIPs.

DUAL Tokenomics

The governance token and de facto DAO of the Dual Finance ecosystem are Dual Finance (DUAL) tokens. Holders of DUALs may suggest modifying the strike and maturity selection as well as any other optional element, including the addition of new goods. DUAL tokens, which Dual Finance may use to inventory risk rather of hedging every DIP with market makers, indirectly represent long option exposure to the DIPs. The DUAL holders may decide to burn DUAL with any proceeds from the protocol.

Voting escrow rights will be included in DUAL tokens, allowing emissions of DUAL Staking Options to be directed based on the products that receive the most votes, encouraging increased participation and APY. In the end, the use of DUAL tokens enables the control of the Dual Finance treasury to be utilized to incentivize all project-related tasks, including technical development, code audits, bug bounties, administrative, legal compliance, business development, marketing, and liquidity provisioning.

Joint Finance DAO is going to create a DUAL Constitution. The DUAL Constitution will set up the parameters in a way that is long-term beneficial to the Treasury. The parameters will take into account the minimum and maximum DIP and SO size ranges, moneyness, maturity, and boundaries for incentive systems. The Constitution’s limitations are meant to be unchangeable, although they can be changed by unanimous votes with strict quorum requirements.

To maintain Dual Finance flexible and creative, the DAO will also implement a second, less demanding barrier for business-as-usual ideas. These steps will make sure the protocol can continue to function even in the absence of early contributors. The objective is to build a self-sustaining, rug-pull resistant DAO and treasury.

Conclusion

Future projects for Dual Finance have a vast and audacious reach. Options can be used to replace any existing incentivization or compensation mechanism with one that more closely aligns aims. Dual Finance aspires to be a driving force in the conception, execution, and dissemination of novel option-based ideas since it believes Decentralized Finance offers the ideal experimental environment for their proliferation. The Dual Finance DAO will lead and manage the DUAL token as a necessary asset in any options-based incentive scheme for new protocols during this developmental process.

Mobile Track

Block Live

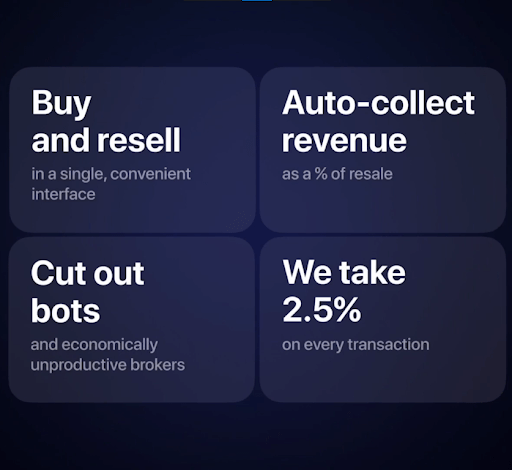

Block Live the ticketing infrastructure that will make solana the most used blockchain in the entire world.

Problems

Online ticketing has been stagnant for 40 years vertically integrated closed marketplaces.

Online ticketing extracts a maximum on fees but has a minimum on transparency.

Since there’s no solution in the market today venues and producers will see approximately zero percent of revenue on secondary sales.

Solutions

Block Live offers a solution fast easy transparent way to buy and sell digital tickets with the royalties for venues and producers baked right in at that marketplace level on our side we’ll be taking two and a half percent on every transaction and fee it’s a fair business model.

We’ll start with crypto itself we’re going to make an event management platform that you love then we’ll push on to integrate payments and identity that works for a broader audience so more people can get involved and we can push into adjacent markets finally within two years when our venue and access management stuff is in place you’re going to see us at some of the largest and best venues in the entire world at least all the ones that are able to walk away from Ticketmaster.

Let’s talk about how this affects SOL itself. First block live drives adoption at a single 18 000 purse event here in Abu Dhabi, each person gets emotionally resonant collectible tickets that they can hold on to for a lifetime or onboarding fast.

Second, the circulation of SOL itself using your technology can offer significant discounts on the face value of those very tickets to those transacting in crypto. An exciting reason to go through the hassle of learning how to use cryptocurrency, but it doesn’t have to end here.

Everything in the events ecosystem can run on SOL. We’re talking f and b, concessions, parking, merchandise, and rewards.

References: https://www.youtube.com/watch?v=rnDnUnW8tbs

Community Choice Award

Beluga

The Community Choice Award, voted on by the larger Solana community went to Beluga, receiving a $10K USDC prize for the project.

WHAT IS THIS NEW TECHNOLOGY?

It can be described in a number of ways:

- Beluga is a decentralized exchange (DEX) and liquidity pool on Solana designed for extremely efficient trading between similarly priced (pegged) assets, without an opportunity cost.

- Beluga also known as Beluga Protocol is a stableswap (an Autonomous Market-Maker (AMM) for stable coins) AMM that enables lower slippage and creation of permissionless pools.

- Beluga Protocol is a revolutionary liquidity network specialized at stableswap AMM on Solana.

From the above definitions, we can point out that Beluga Protocol is a liquidity protocol that provides superior performance for both traders and liquidity providers.

THE PROBLEM

It aims to solve the problem of high impermanent loss and large price slippage across the Solana ecosystem, especially for bridged assets.

THE SOLUTION

To build an ultimate liquidity network incorporating the entire liquidity of the ecosystem to facilitate lower-slippage stableswap on Solana.

HOW IT IS IMPLEMENTED

At the application and model layers of the liquidity network, out of the many products and models provided, there are three (3) products and one (1) model worth mentioning as we perceive them to be the major supports to the solution of incorporating the entire liquidity of the Solana ecosystem in order to lower the large price slippage across the ecosystem, namely:

Multi-Token Pools: – is considered to be the core product of Beluga. It allows users to supply liquidity of pegged assets such as stablecoins to earn Liquidity Provider fees with zero impermanent loss and no opportunity cost.

Permissionless Pools: – allow anyone to create a liquidity pool on Beluga. Once a pool is created it can then immediately be traded on the Beluga swap interface.

Boosted Liquid Mining: – Users can stake the native token BELA to generate veBELA, which can boost Liquidity Mining APR and act as voting escrow token in governance.

Stableswap Liquidity Layer for Aggregators: – With this model, Beluga will integrate with swap aggregators across the Solana ecosystem to bootstrap their liquidity for more efficient and lower slippage stableswaps.

It is good to note that the Beluga’s smart router can detect the best price throughout the ecosystem since it can connect different liquidity pools internally to form up the route that meet user’s trading needs.

The other products and models incorporated in the application and model layers of the network are: Cross-chain solutions, programmable farming, governance, and gauge and bribe. There is also the blockchain layer where Solana sits.

Conclusion:

Beluga is an ecosystem of DeFi products built on Solana and Serum with the goal of simplifying DeFi and a focus on excellent customer experience. I believe their motto sums up the mission, vision, and goal of the technology: Motto for Beluga – “THE REVOLUTIONARY Liquidity Network FOR STABLESWAP”

References: https://www.beluga.so/, https://docs.beluga.so/, Presentation PDF, https://twitter.com/belugadex.

Click here for more on Solana Summer Camp Hackathon